May 2023

Welcome to the May Edition of the Woodcore Changelogs! We are excited to share with you the latest updates and rollouts on the Woodcore ecosystem. Over the past month, we worked on implementing numerous improvements and bug fixes with the goal of enhancing your experience and streamlining your processes.

These updates ensure that Woodcore, in its entirety, continues to evolve and meet the business demands of our customers. We hope you find this documentation informative, and as always, we welcome your feedback.

Let’s dive into the key highlights of this edition!

New Features 🎉

Report Module: Addition of Quarterly Dormant Accounts Report

The regulatory reports section has been expanded to include the Quarterly Dormant Accounts Report (QDAR). This newly introduced report generates a comprehensive list of dormant savings accounts within an organization's tenant.

Dormant accounts are identified as accounts that have remained inactive, without any recorded transactions, for a period exceeding 365 days. Included in the QDAR are essential details such as the customer name, customer account number, account type, date of last initiated transaction, currency, and current balance. This information enables organizations to effectively monitor and manage dormant accounts, ensuring compliance with regulatory requirements and facilitating appropriate actions for account reactivation or closure.

Loan Module: View the Impacted General Ledger for Loan Transactions

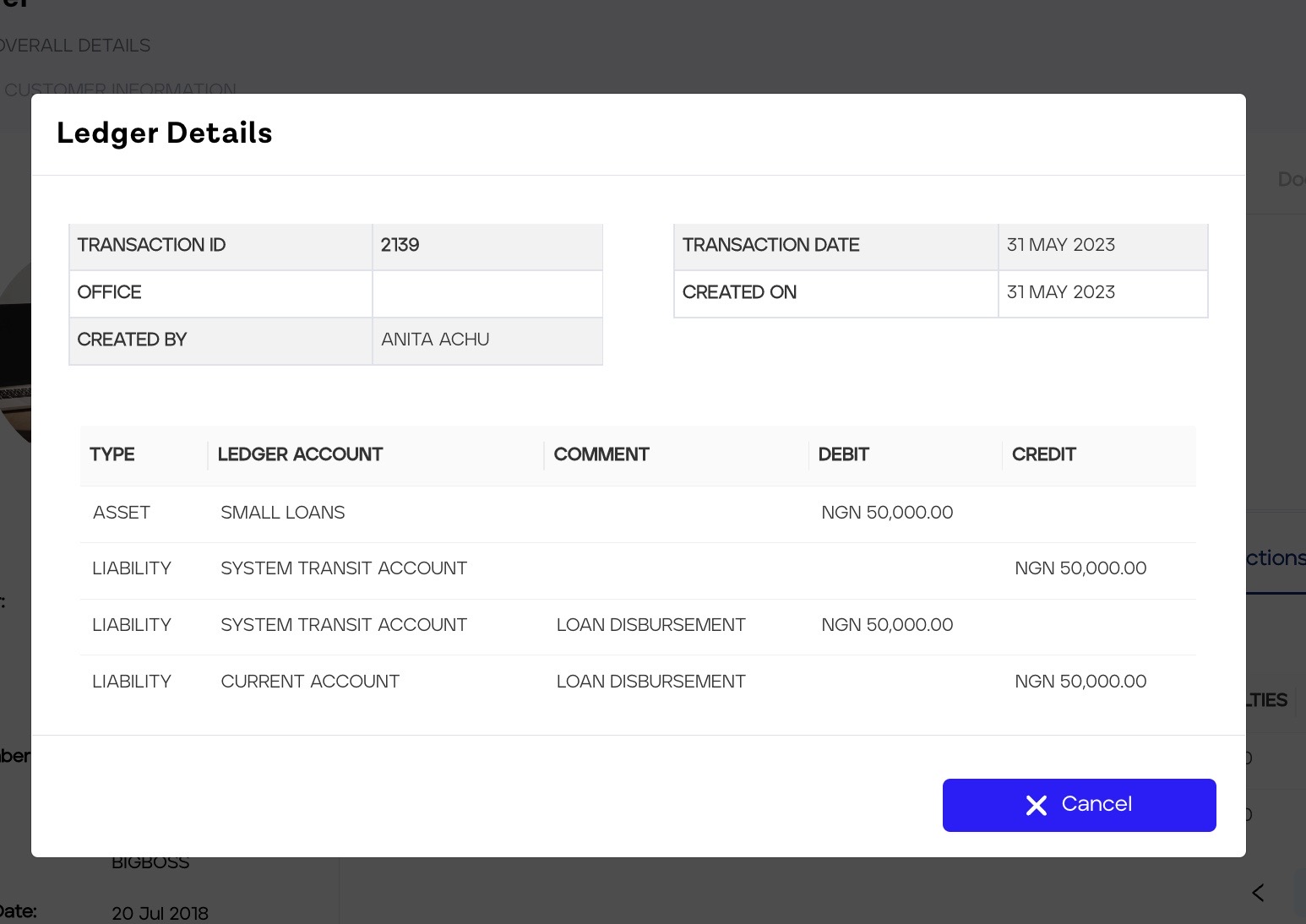

To streamline the process of tracking the ledger entries that were impacted by the loan transaction, a new feature has been added to the loan module. This feature allows users to view General Ledger (GL) entries that were affected by the loan transaction on the loan details page. Transactions such as disbursement or repayment, which occur on a loan account, are recorded in different ledgers attached to the loan account. With this new feature, users can conveniently view the specific ledger accounts and entries related to a loan transaction rather than manually searching these entries.

The details in the ledger not only show the impacted ledgers but also provides additional information, such as the accounting type (e.g., assets or liability) and the corresponding debit and credit amounts associated with each transaction.

This feature is only available for loan accounts where transactions such as disbursement and repayment have been performed.

To view this addition:

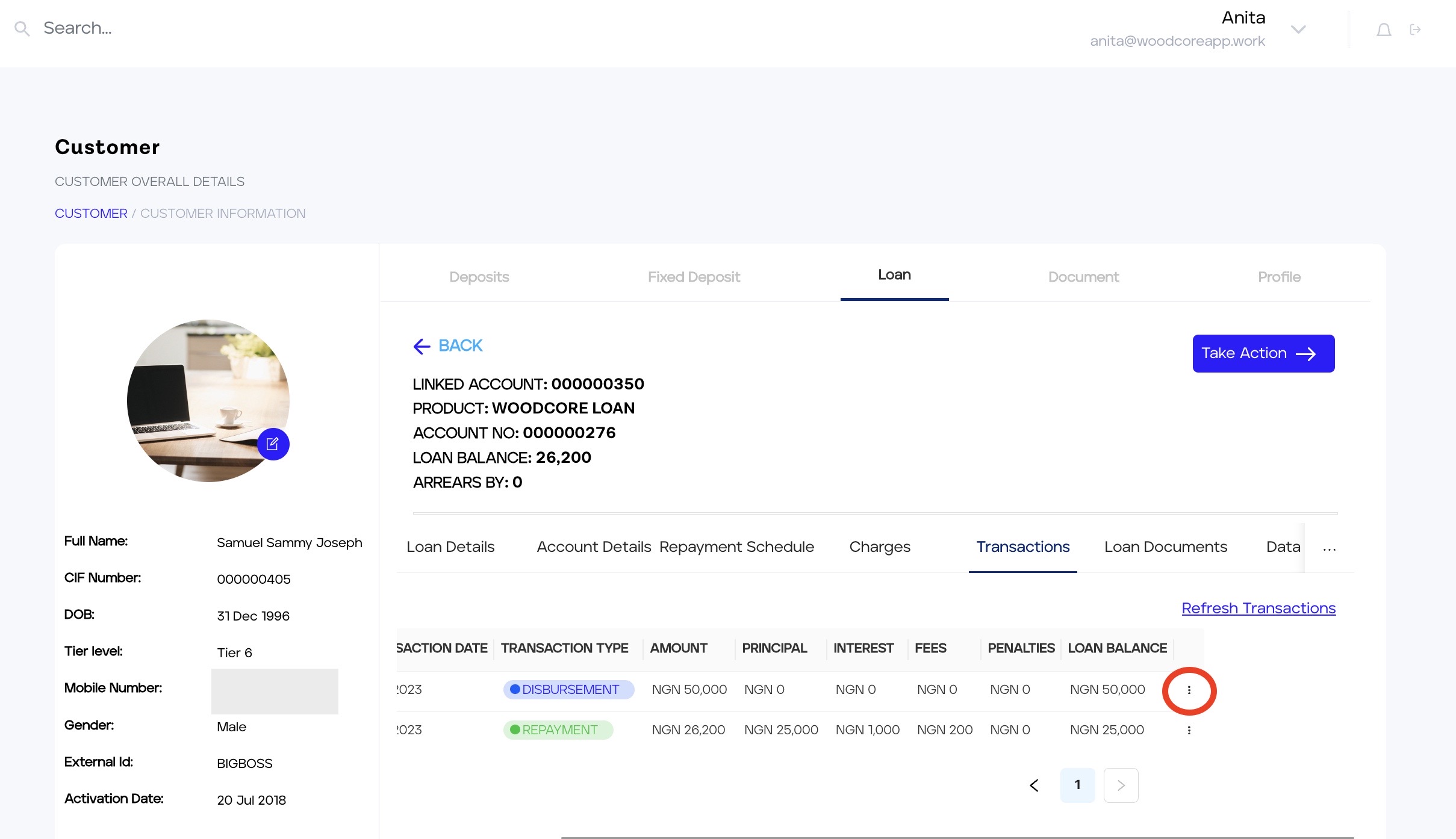

- Select a loan account with an “Active” status. This will display the loan details page.

- Navigate to Transaction and click on the three vertical dots menu at the right of the page. See the section circled in red.

Loan Details Page: Transaction section

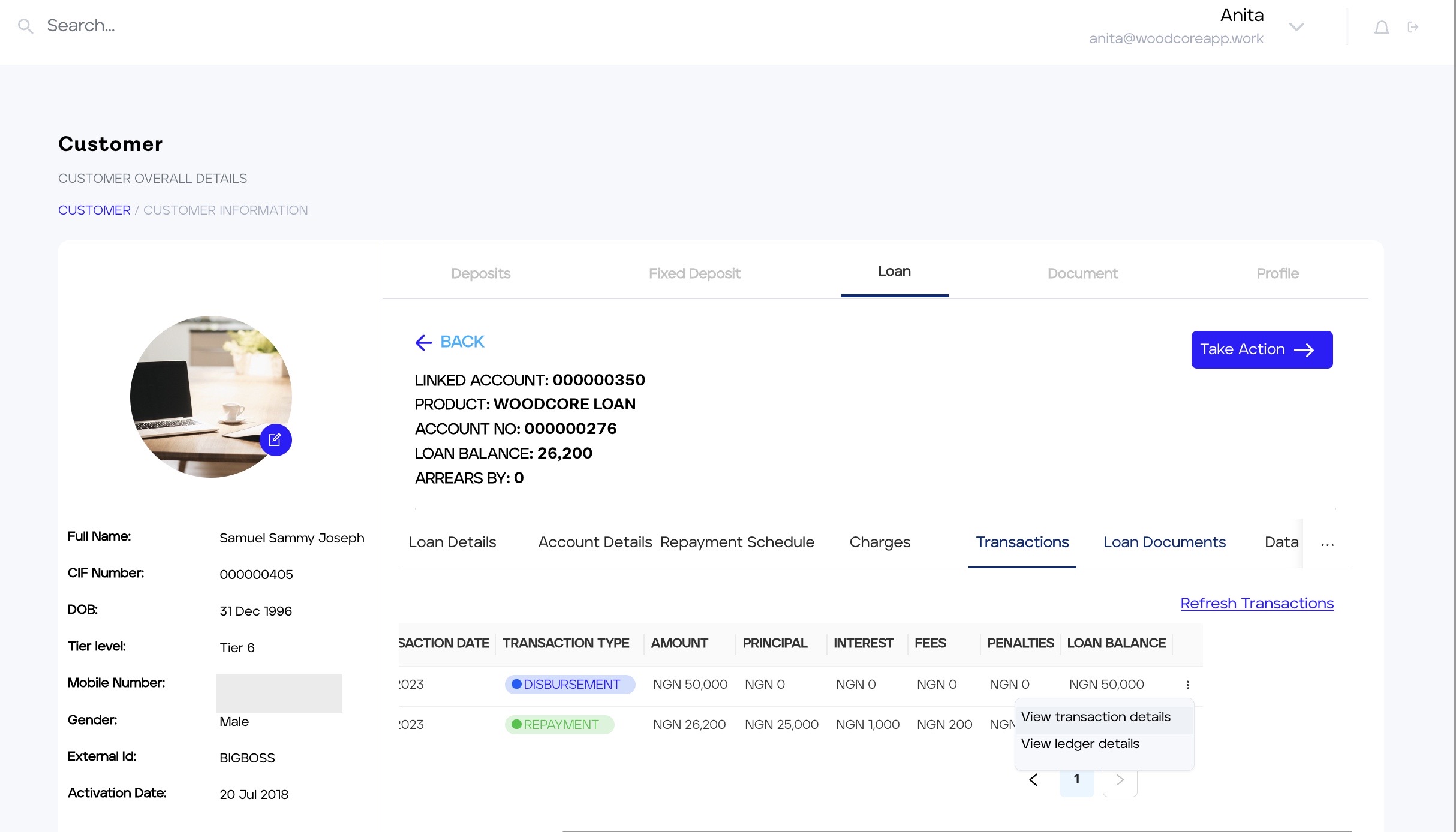

- Select View ledger details from the list.

View transaction details

- This will display a modal containing the account ledger details.

Account Ledger Details

Improvements 🚀

Teller UI: Download Teller Till Based on the Currency View

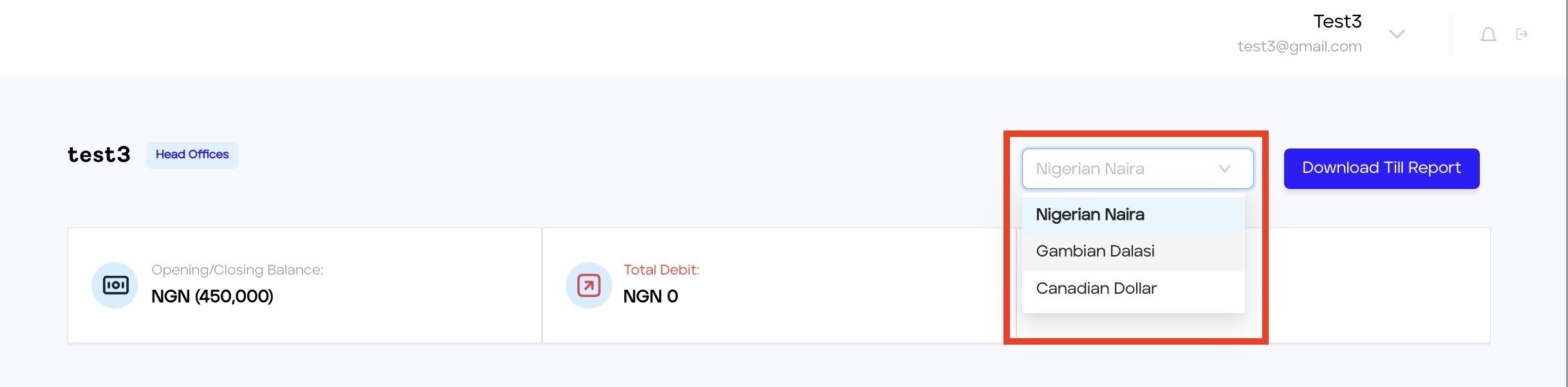

Improvements have been made to the Teller UI to enable the teller download the Teller Till Report based on the selected currency. Following the introduction of multi-currency implementation in the Teller UI, where tellers can carry out transactions using multiple currencies configured on their teller's account by the teller manager. With this, when downloading the teller till report, the teller can select the currency to be included in the report.

For example where a teller has Naira, Canadian dollar, and Gambian Dalasi in their teller account. If Naira is selected in the currency view, the generated teller report will contain Naira transactions exclusively.

This update enables tellers to generate reports that reflect their specific currency requirements and greatly enhances the overall user experience and efficiency for tellers using the Teller UI.

See currency view below:

Currency view menu

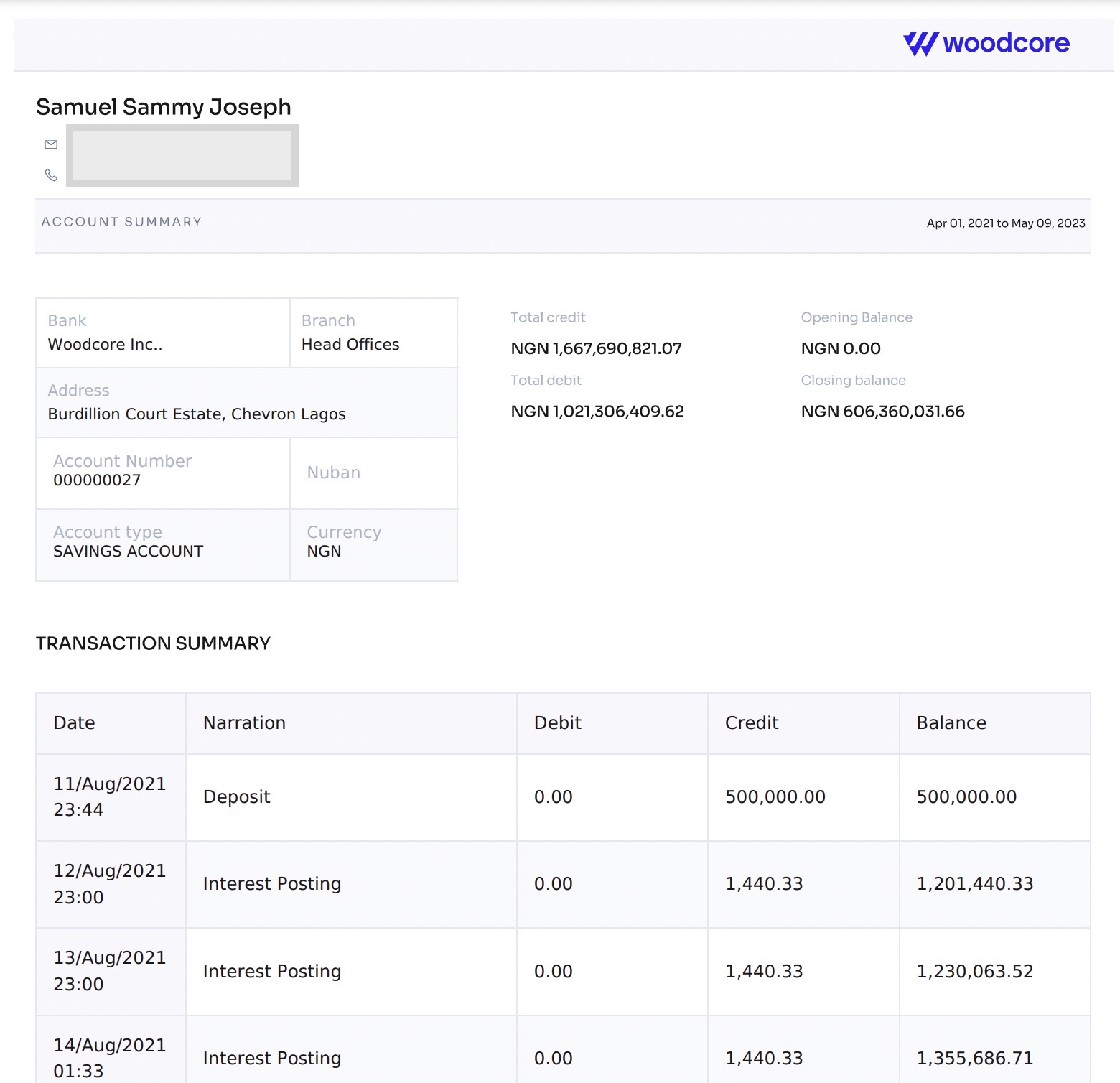

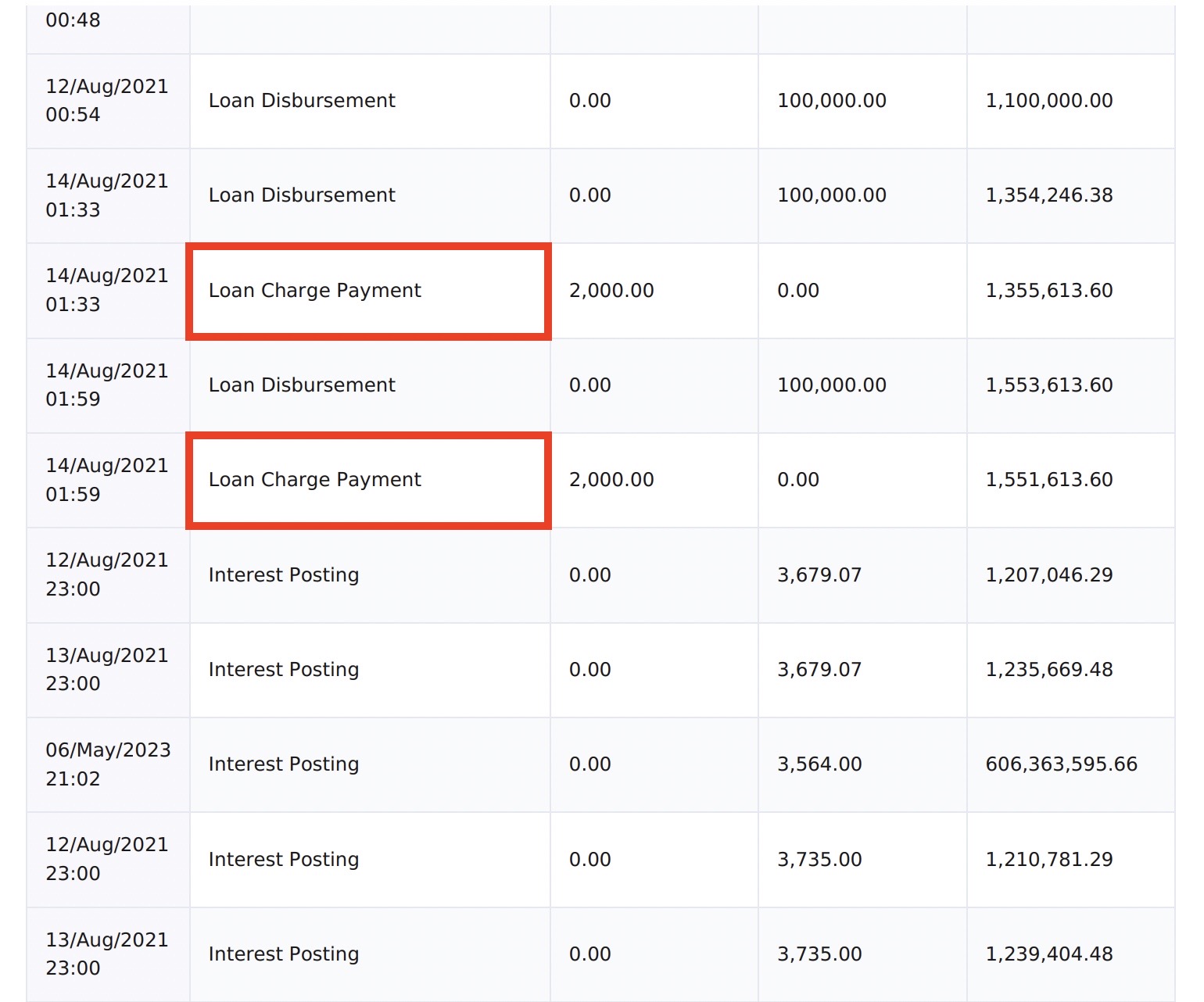

Savings Module: Addition of charge name in account statement charge narration.

The savings account statement has been updated to include the name of the charges deducted from a savings account in the narration section of the statement. This enhancement allows users to easily identify and understand the specific charges that apply to each account.

When charges are deducted from a customer's savings account, the updated statement will display the name of the charges alongside the transaction details. This ensures transparency and clarity regarding the charges applied to the account. Users can now track and reconcile the deducted charges, as the specific charge name and the corresponding amount will be clearly mentioned in the statement.

We believe this update will significantly improve the user experience by providing more comprehensive and informative savings account statements, and users can easily identify the purpose of each deducted charge.

The charges are pre-configured and added to the savings account during the account creation process.

See a sample of the improved account statement:

Improved Account Statement

Fixes ⛏

User Login: Redisplay of QR code for new users

When a new user signs into the console, they are presented with a QR code that they scan using a third-party authentication app. However, we recently identified an issue where, on the failure of the user to scan the QR code on the first attempt, the user would be redirected to the login OTP page instead of the QR sign-in page.

This issue has been resolved! Now, if a new user fails to scan the QR code successfully on the first attempt, the QR code will be redisplayed to them. This allows the user to make another attempt at scanning the code and ensures a successful registration process before being directed to the login-in page.

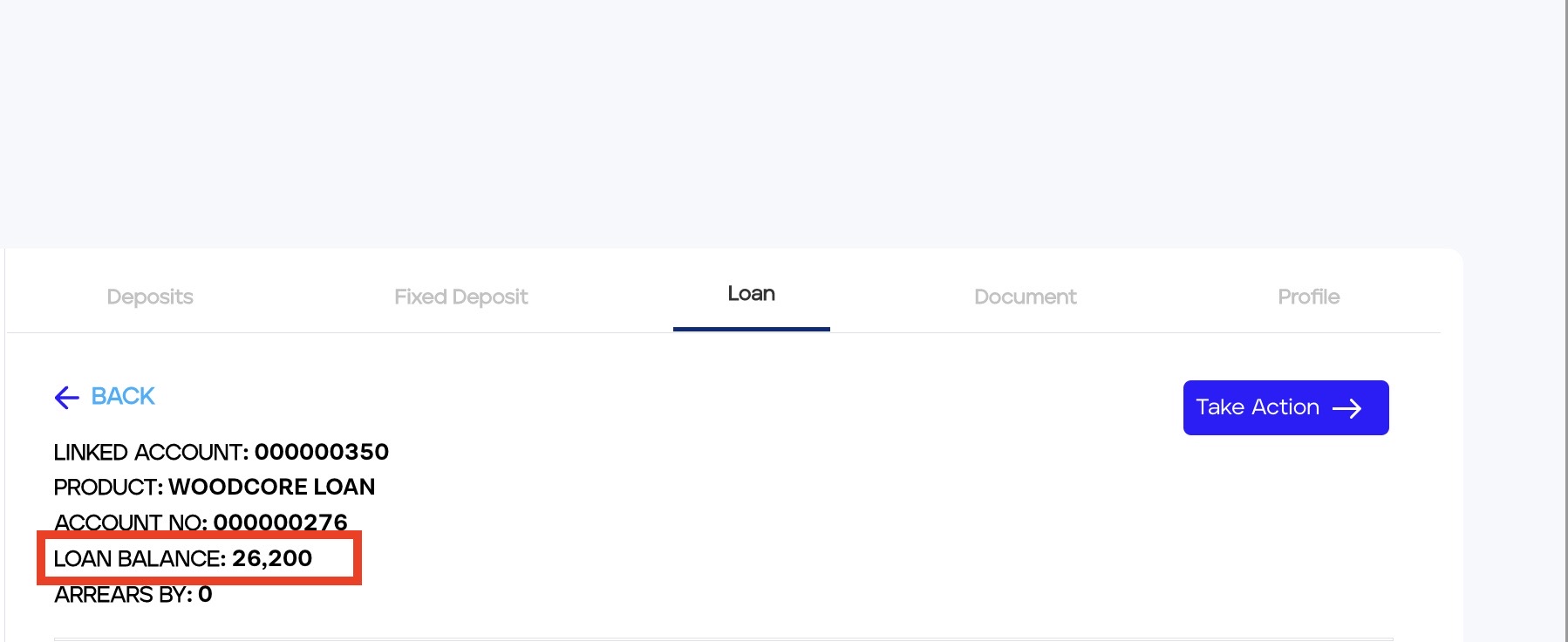

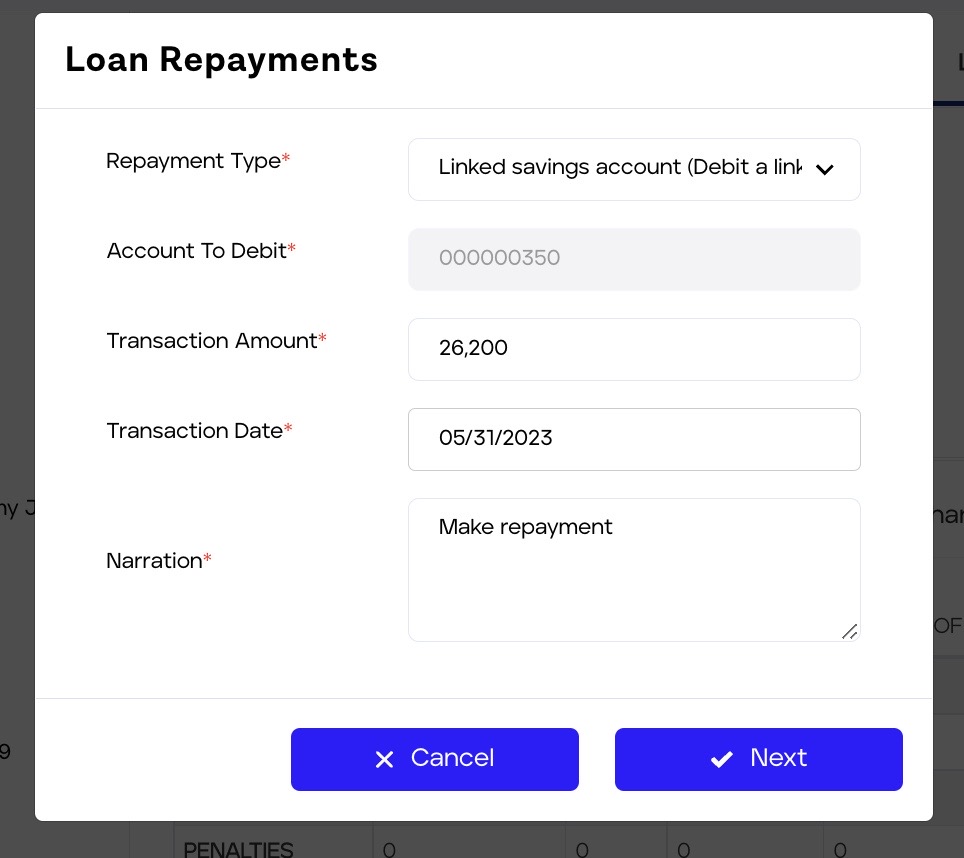

Loan Module: The loan Balance error was resolved to display the correct loan balance.

We are pleased to inform you that the incorrect loan balance error on the console has been successfully resolved. Previously, an incorrect figure was being returned after repayment causing discrepancies in loan balance calculations.

With our recent fix, the loan balance is automatically updated with the correct amount whenever a transaction that alters the balance is executed. This ensures that you have accurate and up-to-date information regarding the loan balance.

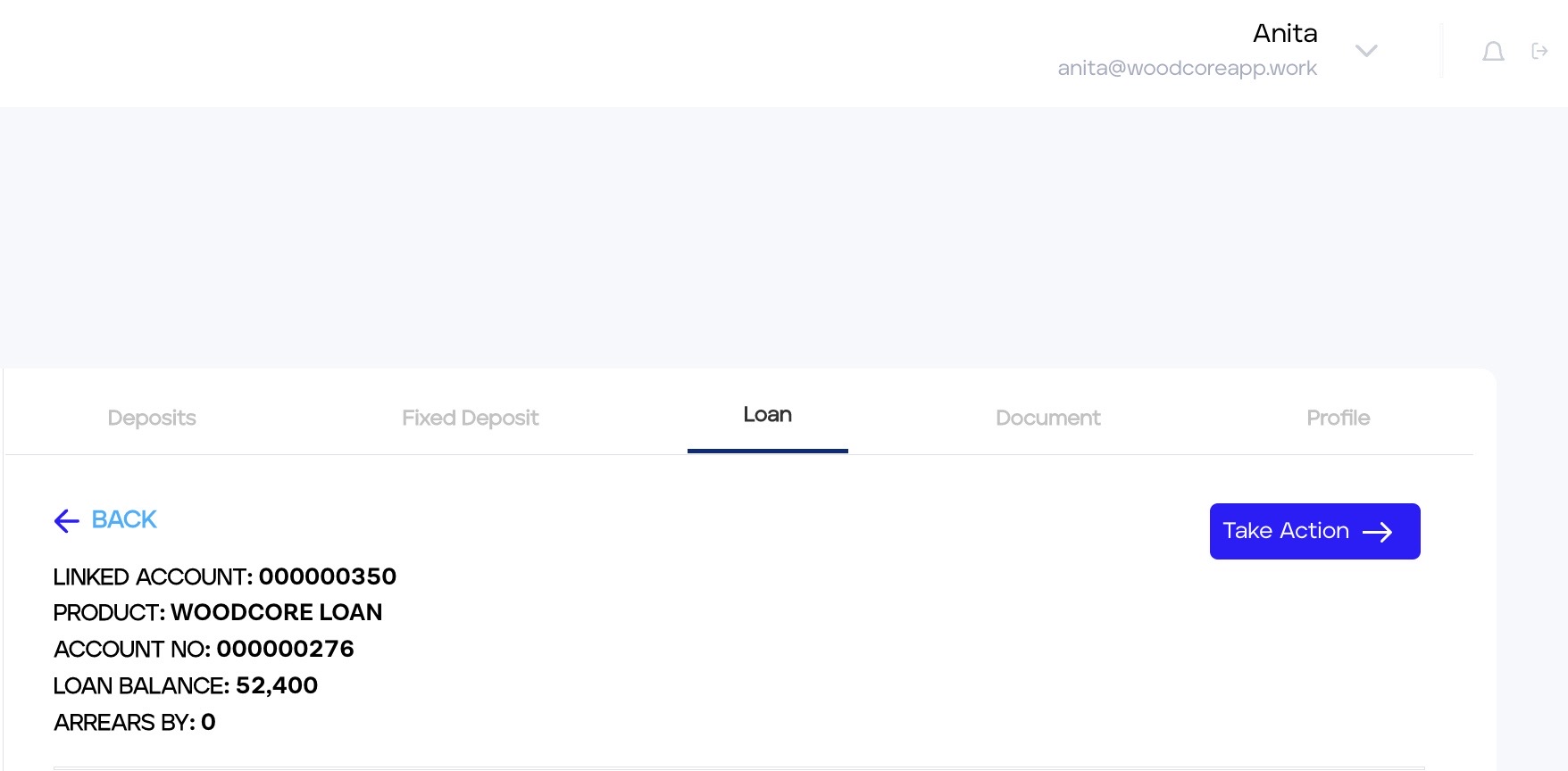

View this fix below:

Current Loan Balance

The image above highlights in red the current loan balance of a specific loan account. Next, we will perform a repayment on the loan account to update the loan balance.

Loan Repayment

In the image above, a loan repayment of N26,200 to the loan account is being made to the account. See the loan balance below for the updated loan balance.

Updated Loan balance

The image shows the loan balance is automatically updated.

Office Management: Users are now able to edit existing office information.

The office modification bug on the production environment has been successfully resolved. Users can now edit and make changes to office information without encountering any issues or restrictions.

With this bug fix, users can confidently update and modify office information as needed. Whether it's changing the office name, date, or external ID, the feature is now fully functional and responsive to your office modification requirements.

Note: The parent office field for an existing office cannot be edited.

API Update ⚙️

Transaction Reader Service: Retrieve transaction error fix

The retrieve transaction endpoint allows users to retrieve a set of transactions existing on the CBA using query filters such as the date, page, per page, amount, transaction type, and account number.

Previously, when filtering by accountNumber, the transaction endpoint returned a 500 error. However, the error has been resolved, users can now filter transactions by account number by passing the accountNumber query to retrieve all transactions endpoint.

Users previously encountered a 500 error when filtering transactions by account number on the list transaction endpoint. Fortunately, this issue has been resolved, and users can now easily filter transactions by passing the accountNumber query to retrieve all transactions endpoint. This will return a list of transactions carried out on the specified account.